University of Dundee

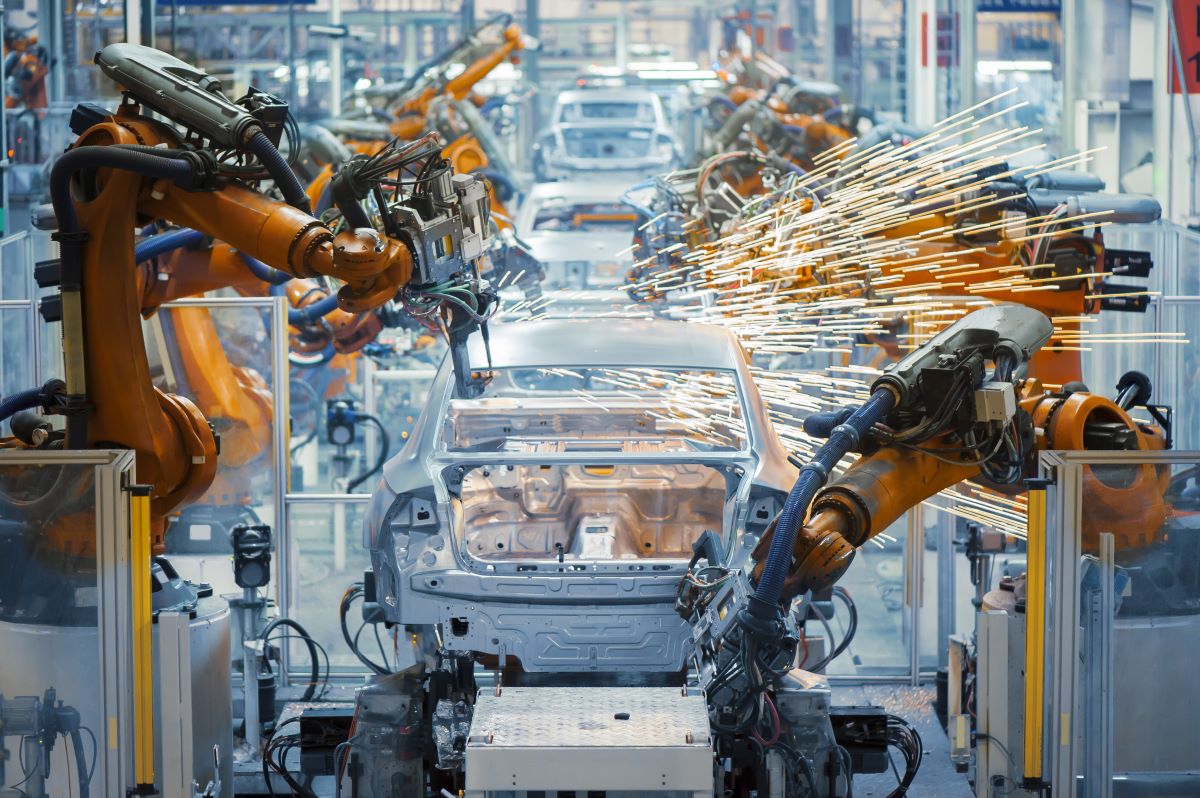

With a manufacturing output equivalent to GBP 3 trillion in 2019, which accounted for 26.8% of the country’s GDP that year, China has the largest manufacturing industry in the world at 35% of global manufacturing output. It is also the only country in the world to have a complete set of all the sub-categories of the manufacturing industry as defined by the United Nations. Thanks to the country’s large domestic market, its well-built infrastructure, its quality human resources, and the Chinese government’s support, the performance of China’s advanced manufacturing and transportation industry has excelled.

Manufacturing in China has post pandemic continued to demonstrate resilience and remains an attractive total supply chain solution for the world’s manufacturers.

CBBC has for decades been working in China’s Manufacturing sector. We provide services to our Members and clients, whether they are large companies or small and medium-sized companies, utilising our accumulated knowledge and well-connected network to facilitate market entry and business development. The CBBC can also conduct research to explore the advanced manufacturing and transport market, identify partners such as distributors or suppliers and recommend locations for setting up factories. We manage events in order to help expand our clients’ market presence in China and our team is also equipped to represent UK companies on the ground, especially under current global travel restrictions.

To get advice from a Member of CBBC’s team or to make an enquiry, please contact us.

China’s automotive market has been expanding rapidly for approximately three decades and reached a peak in 2017 with an annual sales volume of 28.9 million automotive vehicles. Although growth slowed down in 2018 and 2019, it remains the world largest automotive market, accounting for approximately 29% of its world total sales volume in 2019.

Sedan and SUVs are the most popular automotive vehicles in China. Among the 25.8 million automotive vehicles sold in China in 2019, 40% were sedans, 36% were SUVs, 5% were MPVs, 2% were crossovers, and 17% were commercial vehicles.

There are both Chinese and international OEM brands operating in China. Local brands normally supply the middle and low-end market while premium international brands occupy the high-end market.

Discover the highlights of Shanghai's Auto Show 2023 - Watch here.

A total of 1.2 million NEVs were sold in China in 2019, taking over half of the global market size. It is expected that the NEV market will continue to grow in China, as the Chinese government has set a goal to raise the NEV market penetration rate to 25% of all auto sales in the country. For comparison, NEV market penetration was just 4.68% in 2019.

China is increasingly aware of the importance of opening the automotive market to the outside world. In 2018, it decided to cancel the mandatory policy requiring that Chinese shares must be higher than international ones in all automotive joint ventures set up in the country. NEV companies were the first type of automotive ventures to have this restriction lifted, and others are expected to follow in 2023.

Video: Targeting Net Zero: Clean Transport - Can the UK and China work together on the EV transformation?

China is the largest ship-building country in the world. In 2019, the three key indicators of size in the shipbuilding industry, completions, new orders, and orders on hand, were 367.2 million dead weight tonnage (“DWT”), 290.7 million DWT, and 816.6 million DWT respectively.

Over 50% of Chinese-made ships were bulk carriers. The country is trying to upgrade the industry in order to build more high-tech and value-adding vessels, such as LNG/LPG carriers, special engineering vessels, passenger ships, and luxury cruise ships.

China is a major client for global aircraft makers. In 2018, China bought 192 large aircrafts from the European Union, accounting for 20% of the European Union’s aircraft exports. In addition, China also bought 26% of Boeing’s total aircraft output in 2017.

China also works to develop its own large commercial airplanes represented by C919 which can hold around 160 seats. C919 is aimed to be delivered to the client in 2021 and has obtained a total order of 815 airplanes.

See our latest calendar of industry-leading events coming in 2023 for the Advanced Engineering, Manufacturing, and Transport sector.