University of Dundee

Do you know who your Chinese consumers are? They are younger every year, born digital and resonate differently to consumer brands messages than their counterparts in other parts of the world.

As the Chinese consumer economy continues to grow in the wake of Covid-19, CBBC’s Retail and Consumer team can help support your brand at every stage of developing your presence and impact in China. From learning about China’s consumer economy, discovering and analysing your brand performance in-market and optimising your brand presence online, to directly engaging with Chinese consumers: we are here to support you along the way.

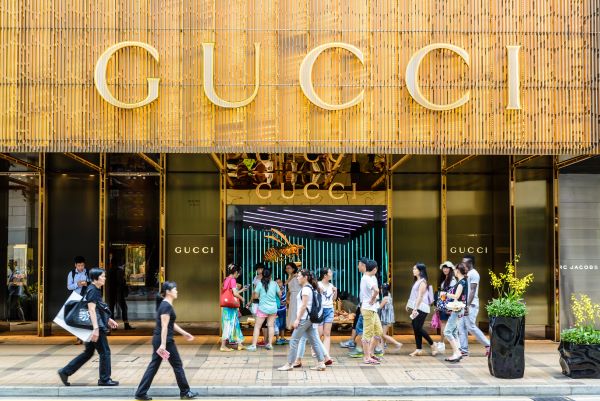

China has become one of the world’s most important retail markets, meaning there are many opportunities for UK companies to take advantage of in the wake of the ever-increasing buying power of China’s middle class. There is currently a particularly high demand for premium quality products, ranging from high street brands to heritage goods, and for made-in-Britain craftsmanship across the food, fashion, and entertainment markets.

As the consumer landscape in China continues to evolve at a rapid pace our team across both the UK and China can enable you to:

Develop your understanding of the China market through CBBCs Consumer Masterclasses, Consumer Surveys and China Gateway services.

Discover opportunities through meeting with Chinese buyers, uncover your brand’s performance online through CBBC’s virtual and offline meet the buyer programmes and digital audit and e-analytics services.

Optimise your market approach and assimilate your brand with China’s online ecosystem through our digital events, workshops and live steaming services.

Engage strategically with the market, exposing your products to Chinese consumers on the ground through CBBC’s UK China Consumer week, Great British Brand’s Festival and Super Brand Day.

The three key factors inflencing the increasing consumption of imported products are changes in family structure (including the second-child policy), the desire for new experiences, and an increased awareness of the quality of purchases made.

Beyond this, a growing per capita disposable income affords consumers both a level of comfort and a sense of luxury to their lives beyond what they knew in the past.

Total retail sales of consumer goods in China reached over £4.8 trillion in 2019, with a Compound Annual Growth Rate (CAGR) of 9.4% over the past five years. With many staying at home, the COVID-19 pandemic saw a rise in use of E-Commerce. China has numerous e-commerce platforms.

Taobao, Alibaba’s C2C platform, reaches 600m Monthly Active Users (MAU) and is the world’s largest e-commerce website. China’s largest B2C platform is Tmall, also owned by Alibaba, with 500m registered customers. Other major players in Chinese e-commerce include Kaola (Alibaba, over 30m MAU), JD.com (417m active users Q2 2020) and RED (or ‘xiaohongshu’, 100m MAU).

For the first quarter of 2020, Alibaba listed a 34% YoY revenue increase, while JD.com also saw a revenue growth of 33.8%. CBEC platform usage increased by 65% in the first three months of 2020 and is forecast to have reached a 2.6% annual increase by the end of the year.

China has the largest market and the highest growth rate for online retail sales in the world. The market reached a value of £1.24 trillion in 2019, and the total online retail sales for consumer goods reached £991 billion, accounting for over one fifth of total retail sales of consumer goods.

The top three online sales categories in 2019, in terms of market share, were apparel and accessories, daily necessities, and household appliances. Sales of cosmetics, furniture, and jewellery grew faster than other categories in 2019. Cosmetics, food and drink, and daily necessities accounted for approximately 73% of total CBEC sales in China in 2019, and cosmetics had the highest YoY growth rate at 46.2%.

Tmall, JD.com, Kaola and RED offer CBEC platforms. The largest is Tmall Global: access to their large but highly competitive market is invitation only and expect to pay a deposit, annual fee, and sales commission.

In 2019, the Double 11 E-Commerce Shopping Festival reported the largest sales figures of any shopping event in the world. The 2020 Festival set new records: a $56 billion sales boom demonstrates China's sustainable consumption power.

China’s offline retail market embracing new technology to enhance the retail experience, including Artificial and Virtual Intelligence, as well as block chain technology.

Second-tier cities, third-tier cities, and even rural locations are becoming a key battleground for both domestic and international retailers, and particularly for those that focus on online business.

Development of smart logistics, along with the rapid adoption of smart phones and mobile commerce, is increasing the number of consumers able to access and buy international brands online.

With the unparalleled power of Chinese social media and e-commerce influencers over their followers, there is little doubt that Key Opinion Leader (KOL) marketing should be a key consideration for any international brand when setting their China marketing budget.

During the Covid-19 China lockdown in February 2020, millions of Chinese consumers turned to live-streams for both e-commerce and entertainment and as the consumer economy rebounded strongly, China had 562 million livestreaming users back in June and one the most dynamic influencer markets in the world.

Key Opinion Leaders and Key Opinion Consumers are essential advertising bases. Both are trusted by large followings and are frequently sent samples by brands. Some of the most important work is done in E-Commerce livestreaming – a relatively new industry with a combined revenue of US$98 billion in 2019. In October 2017, Viya (an important KOL and E-Commerce live streamer on Taobao Live) made a small Chinese fur shop obtain 70m followers overnight.

Idol endorsement is also an effective retail sales boost, brands promoted on social media platforms like Weibo: in 2020, the stock of all companies endorsed by dancer Wang Yibo rose by an average of 32%.

CBBC's Influencer Focus Group service is a unique offering UK consumer brands to connect with top-notch London-based Chinese influencers and student ambassadors, providing valuable opportunities to gain first-hand insights into the brand perception amongst potential Chinese consumers. It is a must-have for UK consumer brands looking to tap into the potential of the Chinese market and drive sales growth.

It maximises your market impact by bridging the cultural gap and leveraging the power of local insights. Unlike in the UK where social media platforms such as Facebook and Instagram reign supreme, the Chinese market operates differently, with its own preferred channels for product research, communication, and reviews. Our focus group discussions delve deeper into the mindset and narratives of Chinese consumers, providing key insights into their purchasing motives.

The 45-minute focus group sessions are designed to deliver impactful results, offering a platform for brands to cover a wide range of topics, from new product launches to packaging, consumer trends, purchasing behaviour, and market entry strategies.

With CBBC’s Influencer Focus Group service, you can confidently make strategic decisions to approach, innovate, and succeed in the Chinese market

See all of the new and upcoming events and initiatives in our latest diary.

View the CBBC Member Directory for Retail and E-Commerce here.

The Brands of Britain Tour is a newly established programme launching next year which aims to bring together UK brands with multinational corporations & state-owned enterprises in Beijing & Shanghai.

In order to help your brand grow its customer base and boost brand awareness among target audiences, the China-Britain Business Council (CBBC) has developed the Brands of Britain Tour.

The Brands of Britain Tour is a programme through which we will visit the headquarters of multinational corporations (MNC), large Chinese enterprises, high-end retailers, and luxury hotel groups on a regular basis and share with them samples and trials of products and services from the programme’s participating brands.

In order to promote the best of British lifestyle products and raise the profiles of British consumer brands via marketing campaigns with luxury hotels, the China-Britain Business Council (CBBC) presents an opportunity for your prestigious products to be incorporated into a three-month (August-October 2023) British lifestyle experience programme at select Lux Collective hotels.